A boom in the artificial intelligence (AI) market at the start of 2023 kicked off just when tech stocks needed it most. Companies were dealing with the aftermath of an economic downturn the year before, which led the Nasdaq-100 Technology Sector to plunge 40% in 2022. However, the launch of OpenAI’s ChatGPT seemed to breathe life back into the industry and reminded investors of the vast growth potential of tech stocks. As a result, the same index has soared 88% since Jan. 1, 2023.

Companies across tech have ventured into AI, an industry projected to hit close to $2 trillion in spending by the decade’s end. The generative technology can potentially boost countless sectors as demand for AI services and the chips that make them possible soar.

Despite this explosion of growth in the past 18 months, it’s not too late to invest in the market and profit from its long-term development. Here are two AI stocks to buy hand over fist in July.

1. Intel

Intel (NASDAQ: INTC) has been slightly overlooked amid the rally in AI. While rivals like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) have seen their stocks rise 745% and 144% since the start of last year, Intel’s share price has increased a more moderate 18%. A series of challenges over the last decade have made Wall Street weary, including lost market share in the chip industry and the end of a lucrative partnership with Apple.

However, Intel has announced significant structural changes in its business model over the last year that could trigger a change in fortunes for the chipmaker. The company is shifting its focus to two high-growth markets: AI and manufacturing. Consequently, Intel unveiled its Gaudi 3 AI accelerators this year, which undercut Nvidia in price and offer similar performance.

Meanwhile, the company is building chip plants throughout the U.S. as it works to retake the top spot in manufacturing and become the primary chip fab in the country. The move could allow Intel to profit from rising chip demand across the market as companies like Nvidia and AMD outsource their manufacturing.

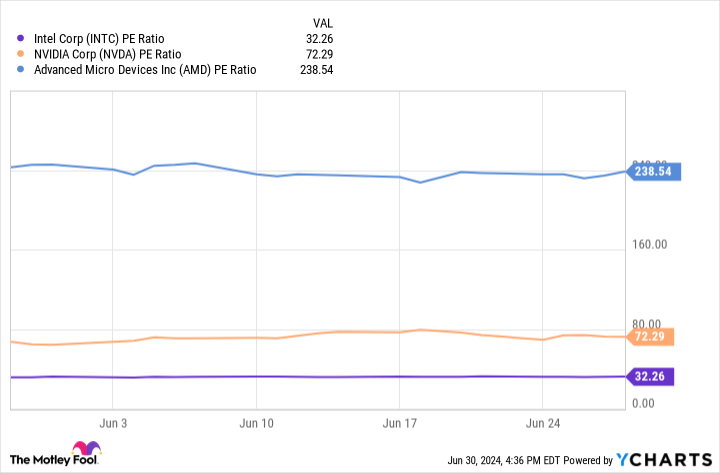

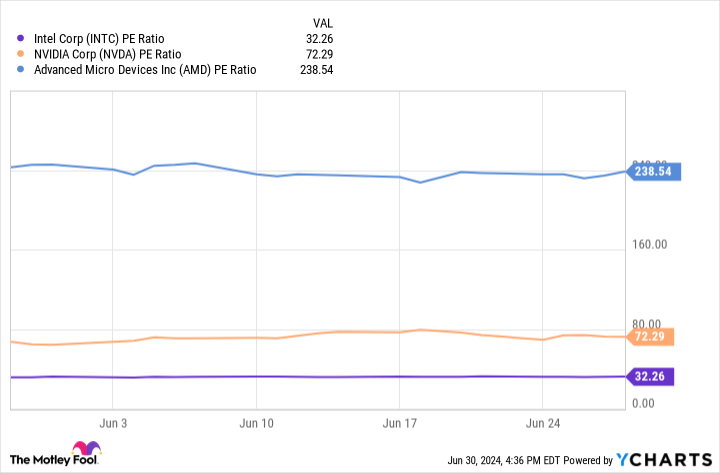

Moreover, the data in the table above shows Intel’s stock is a bargain compared to its competitors. Its considerably lower price-to-earnings ratio (P/E) suggests its stock offers far more value, making it a no-brainer this July.

2. Alphabet

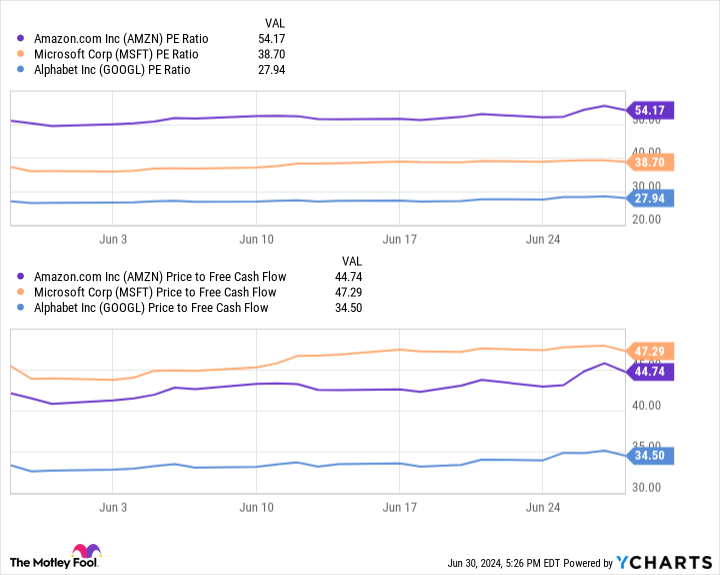

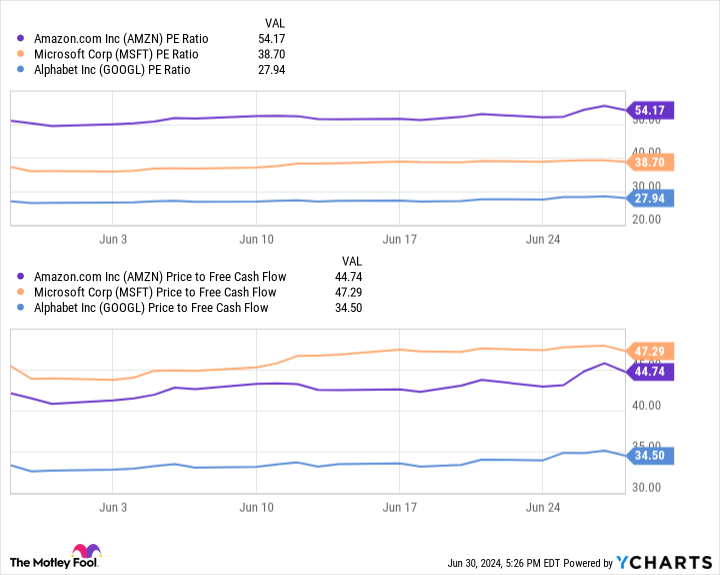

Like Intel, Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) stock is trading at a significantly better value than its rivals. The company is in steep competition with cloud giants Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) as AI has boosted the entire industry. Alphabet has the third-largest market share in cloud computing (after Microsoft and Amazon), yet is quickly catching up.

Meanwhile, the chart below shows Alphabet’s shares potentially offer far more value than its rivals. The Google company’s lower P/E and price-to-free-cash-flow ratios suggest Alphabet could be one of the best-valued stocks in AI.

In the first quarter of 2024, Alphabet’s revenue rose 15% year over year to $81 billion, beating analysts’ expectations by nearly $2 billion. The company profited from a 14% spike in Google Services revenue and a 28% increase in Google Cloud sales. Alphabet’s cloud revenue growth is especially impressive as it beat Microsoft’s Azure and Amazon Web Services in cloud growth for the quarter, with sales for those platforms rising 21% and 17% year over year.

Cloud computing has become a crucial growth area in AI as businesses increasingly use such services to integrate the technology into their workflows. As a result, Alphabet has invested heavily in expanding its AI offerings over the last year, introducing new tools to Google Cloud, adding generative features to Google Search, and improving its ad services.

Alphabet hit $69 billion in free cash flow this year, only strengthening the argument for its stock. The figure suggests the tech giant has the financial resources to continue investing in its business and keep up with its rivals. That, alongside its bargain price point, makes Alphabet a stock to buy hand over fist this month.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $761,658!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks to Buy Hand Over Fist in July was originally published by The Motley Fool