Markets rose Friday, boosted by earnings from Google parent Alphabet Inc. and Microsoft Corp., two of the so-called Magnificent Seven stocks, which both reported beats on revenue and earnings.

Microsoft’s next quarter revenue outlook was higher than analyst expectations while Alphabet announced it would begin paying a $.20 a share dividend. Alphabet jumped more than 10% after the open and Microsoft rose over 2% in early trading Friday.

Rallies in the stocks boosted the broader markets, with the Nasdaq surging 2.2% and the S&P 500 adding about 1% midmorning. ETFs tracking the indexes gained similarly: SPY, the SPDR S&P 500 ETF Trust was 1.1% higher while QQQ, the Invesco QQQ Trust which tracks the tech-heavy Nasdaq, popped 1.7%.

MAGS, the Roundhill Magnificent Seven ETF which holds Mag 7 stocks in its fund soared more than 3%.

Microsoft and Alphabet’s earnings surprises are helping improve the less-than-rosy picture painted earlier this earnings season by tech companies. Tech earnings have been in focus since last week as investors wondered if the megacap tech companies that have led the markets for so long would continue to do so in the future.

While Microsoft and Alphabet earnings delighted investors, Tesla Inc., Netflix Inc., and Meta Platforms Inc. reported disappointing results that kept markets under pressure earlier in the week.

The Dow was little-changed, adding half a percentage point. DIA, the SPDR Dow Jones Industrial Average ETF Trust was up 0.2%.

The better-than-expected earnings from Microsoft and Alphabet helped investors look past inflation data released Friday. The personal consumption expenditures (PCE) for March rose 0.3% for the month, the Commerce Department reported Friday. The monthly rise was in line with expectations from economists polled by Dow Jones. But the year-over-year rise of 2.7% (minus the volatile food and energy categories) highlighted how stubborn and persistent inflation has been.

The data came just a day after the Commerce Department released first quarter PCE figures, giving investors an advance preview of what was to come today. Thursday’s advance reading of PCE torpedoed investor hopes that rate cuts were coming anytime soon.

PCE remains the Fed’s preferred inflation gauge, and is a key piece of information for policy meetings about rate cuts. The Fed is expected to hold rates steady next week at the FOMC meeting, but questions still remain on when investors—and the economy—can anticipate relief from a high interest rate environment.

According to the CME Fed Watch Tool, markets aren’t anticipating a rate cut until September.

Bond yields slid on Friday, just a day after popping on data that economic growth was slowing. As bond prices rose (prices and yields have an inverse relationship), TLT, the iShares 20+ Year Treasury Bond ETF, jumped nearly 1%.

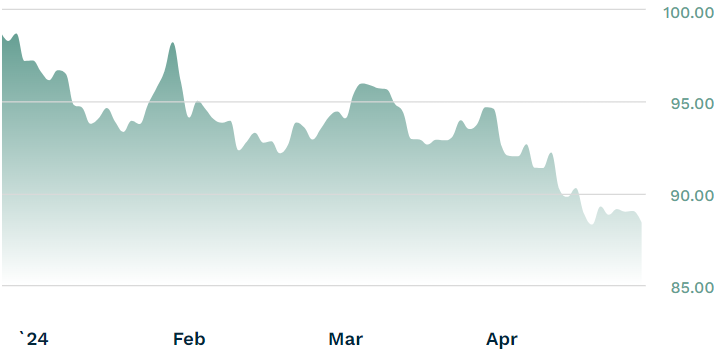

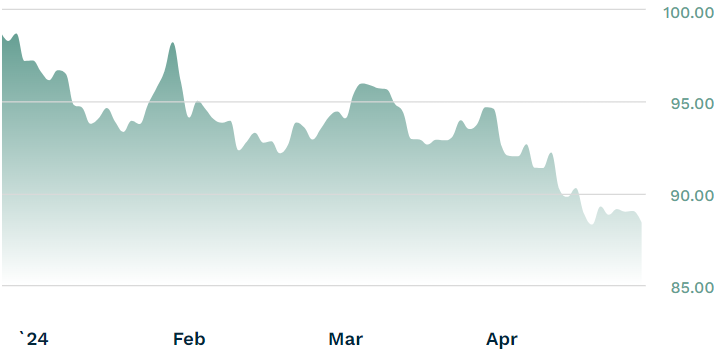

Fixed income investors have been left reeling as anxieties and questions over interest rates have sent bond ETFs on a rollercoaster ride.

TLT YTD Chart

Source: etf.com

As investors continued to cheer about better than expected tech earnings, tech ETFs remained the most active by trading volume, according to etf.com data. TQQQ, the ProShares UltraPro QQQ and SQQQ, the ProShares UltraPro Short QQQ which bets on falling tech prices saw trading volumes of 36.2 million shares and 67 million shares respectively.

Permalink | © Copyright 2024 etf.com. All rights reserved