Since the start of 2024, Nvidia‘s (NASDAQ: NVDA) stock has risen around 150%. After a run like that, many investors assume that they’ve missed the boat and the stock cannot go any higher. The problem is that the same thinking has caused them to not buy the stock after it’s risen 50% or 100%.

On a similar note, Nvidia’s stock is up nearly 750% since the start of 2023. Despite the stock rising significantly, every day was a fantastic buying opportunity in 2023. There is a natural instinct called price anchoring, where your mind latches on to the price you could have paid in the past.

Investors need to look at the assumptions baked into Nvidia’s stock and decide: Could it go higher in the future? If those assumptions are reasonable, then maybe it’s not too late to buy Nvidia stock.

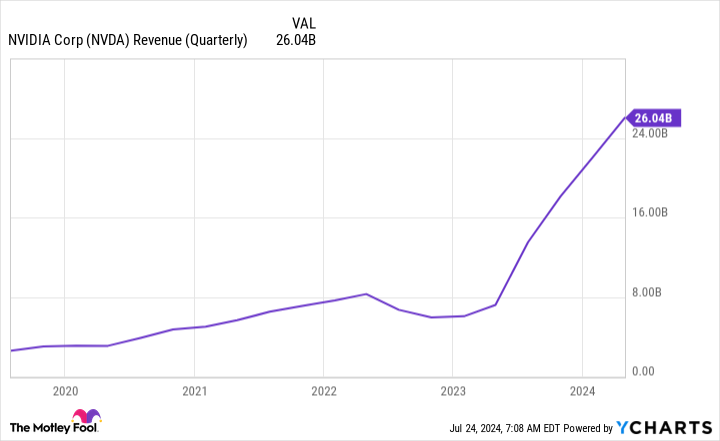

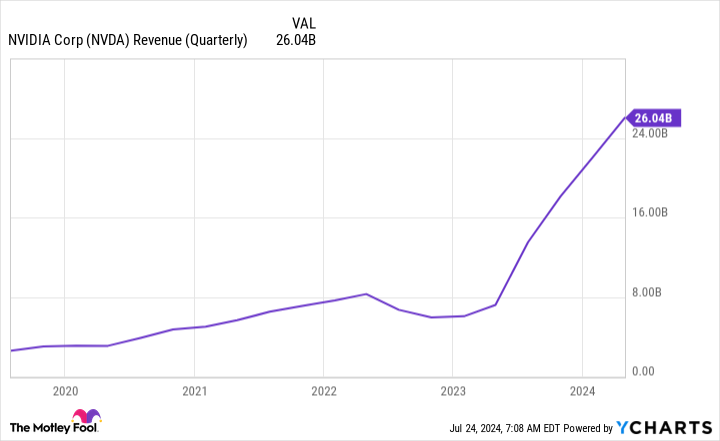

Nvidia’s revenue and profits are reaching jaw-dropping levels

Nvidia’s rise has been tied to its primary product: graphics processing units (GPUs). GPUs are utilized in high-performance computing applications because of their ability to process multiple calculations in parallel. Without this ability, little of the innovative artificial intelligence (AI) technology we see today would be possible. As the AI race continues, anyone competing is buying as many Nvidia GPUs as they can get their hands on, which is why the stock has done so well.

Nvidia reported three straight quarters of its revenue tripling, causing its stock to shoot up to record highs.

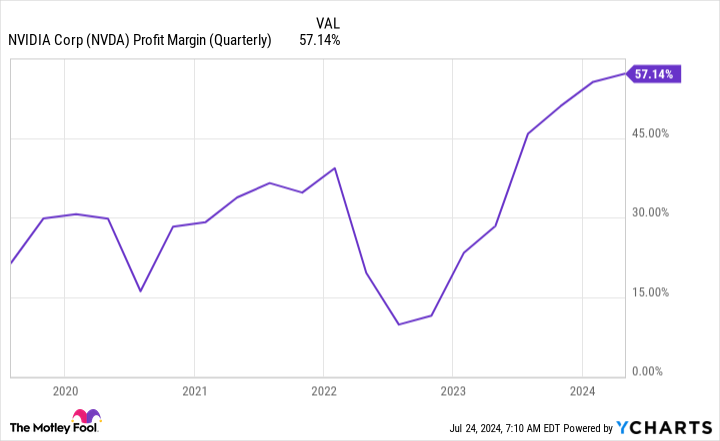

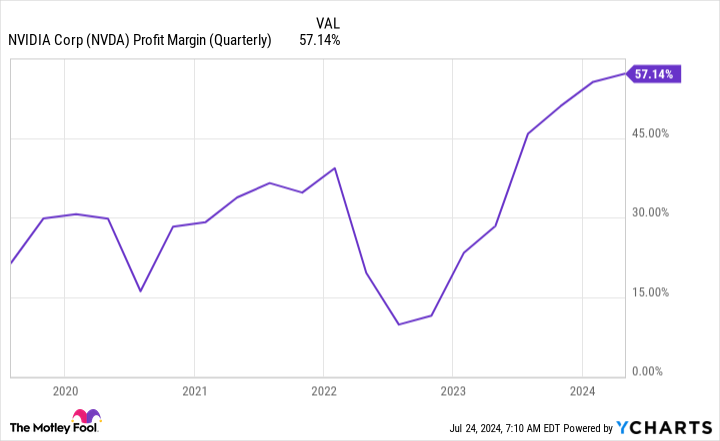

Because Nvidia already had the production capabilities to produce these GPUs, its margins also dramatically rose because of unit economics.

When determining where Nvidia’s stock can go from this point, investors need to determine if Nvidia can keep growing and maintain its top-tier profit margins.

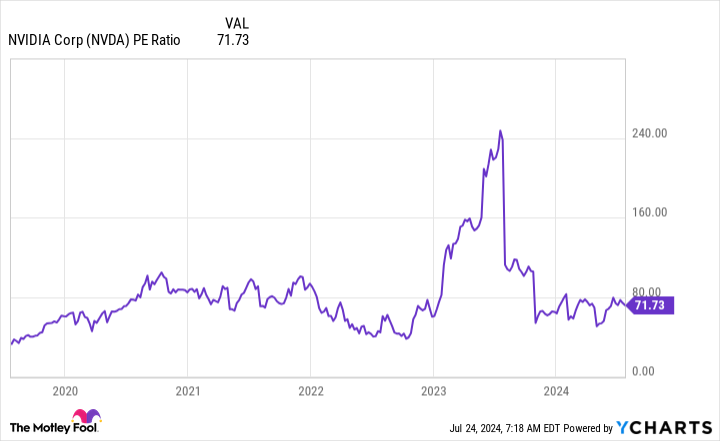

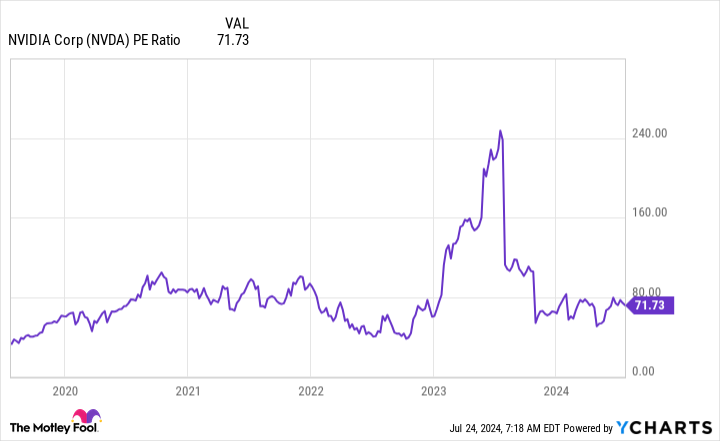

The stock isn’t cheap right now, but it could grow into its valuation

Nvidia’s revenue growth is a bit tricky. First, Nvidia has historically been a cyclical company. This means the company goes through ebbs and flows of demand. Right now, demand is extremely high, but the question is whether it can stay elevated for years. With the amount of AI infrastructure that has yet to be built, many investors believe that Nvidia could continuously deliver high levels of revenue. Furthermore, data center GPUs only have a lifespan of around five years, so they will need to be replaced around that time. When that occurs, it will ignite another demand wave for Nvidia’s GPUs that could help it maintain or grow its revenue.

Nvidia’s margins are also suspect. Because they’re reaching such high levels, some companies want to cut out Nvidia and design the GPUs or AI-specific processing chips in-house. This threatens both Nvidia’s revenue and margins, but the problem is that these products are very specific to a particular use case. Nvidia’s GPUs excel in a broad range of calculation types, which is why they will likely remain incredibly popular.

While these are undoubtedly challenges, the current results are heavily leaning in Nvidia’s favor.

Now, we need to see what expectations are built into Nvidia’s stock. At 71 times trailing earnings, Nvidia’s stock is very expensive.

Because Nvidia is a top-tier company with excellent margins, it’s not unreasonable to expect the stock to have a long-term multiple of 30 times trailing earnings. If we use that multiple as its base case, then Nvidia would need to grow its profits to $100 billion to meet that criteria at its current valuation.

Wall Street analysts expect revenue of $165 billion in fiscal year 2026 (ending January 2026). If Nvidia can maintain its 57% profit margin, that would result in $94 billion in profits, which is essentially right where it needs to be to achieve the valuation level I set.

That’s about a year-and-a-half of growth baked into the stock already. But the question is, is that price worth it? If Nvidia’s growth extends out five years, then absolutely it’s worth it. If not, then investors could be in for a rude awakening.

However, all signs point to the booming AI trend not being wrapped up in a year-and-a-half, which means it’s not too late to buy Nvidia stock.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $688,005!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 22, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Nvidia Stock? was originally published by The Motley Fool