It’s difficult to make a 147% return in a matter of months, but that’s what Nvidia (NASDAQ: NVDA) achieved with a multimillion-dollar investment this year. The investment was one of many AI companies Nvidia decided to back. All were companies that it has worked with in the past, so it presumably knows them quite well. Despite the huge profit, Nvidia appears to be holding on to its fairly recent stock purchases. Investors looking for maximum growth should consider jumping in.

This AI stock could have 1,000% more upside

Less than a year ago, Nvidia plowed $3.7 million into SoundHound AI (NASDAQ: SOUN) stock. Shares have risen by 147% since then, but there’s reason to believe they could rise another 10 times in value over the long term. But before you invest, there are a few things you need to consider.

At its core, SoundHound AI is a company focused on bringing AI to everything sound-related. From voice assistants to drive-thru ordering, anytime you chat with a speaker, SoundHound AI wants its technology to be there. With more than a decade in operation, the company has amassed more than 200 patents and an impressive customer list that has continued to grow.

In 2022, for example, it signed a seven-year contract with Hyundai to power its voice-driven AI capabilities. Drivers will be able to chat with their vehicles not only to send messages, get directions, or toggle the air conditioning but also to check in on maintenance issues and discuss how the vehicle has been performing. It’s impressive stuff. Over the next few years, that giant user manual sold with new cars could be replaced with a simple conversation — one conducted directly between you and the vehicle.

SoundHound AI has signed several vehicle manufacturers as customers. But it’s also in other industries, including restaurants and fast-food chains. Applebee’s and White Castle, for instance, are piloting the technology to improve order times and reduce overhead costs. This is perhaps one of the most popular ways we will all be interacting with AI technologies in the near future.

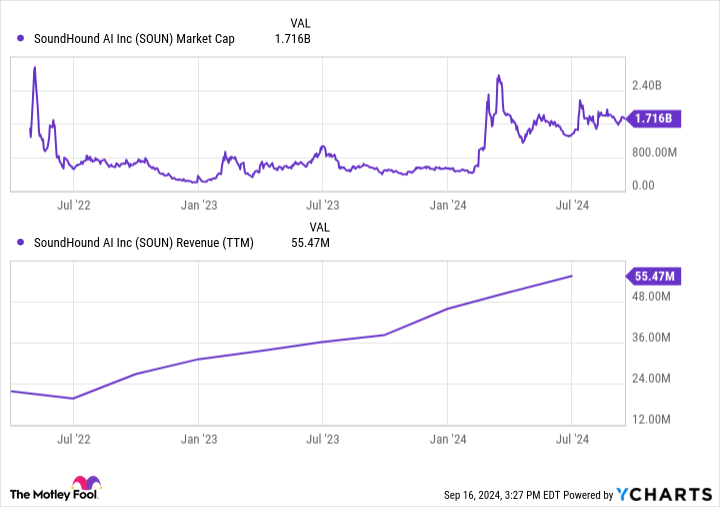

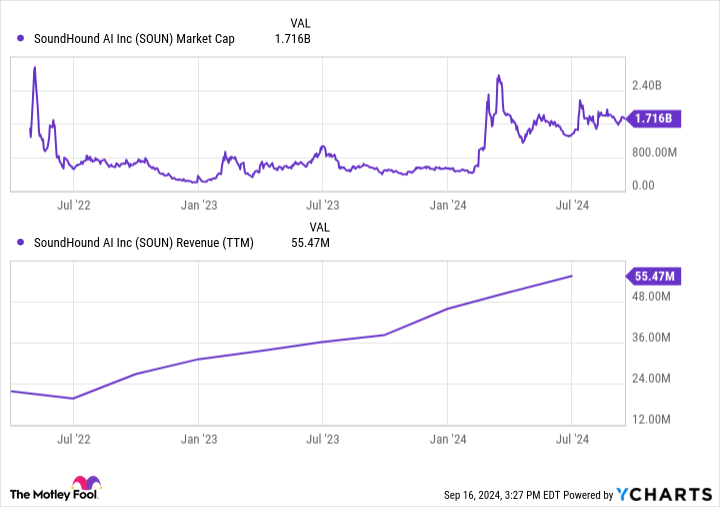

Despite its sizable tech portfolio, growing customer base, and sizable end markets — not to mention Nvidia’s backing — SoundHound’s market cap remains just under $2 billion. To rise 1,000% in value, the company would need to reach a valuation of around $20 billion. That’s not much of a stretch in the volatile AI industry, which could be one of the largest growth opportunities in a generation.

Shares trade at a price of 22 times sales, but over the last two years, revenue has grown by more than 150%. If it can replicate these growth rates, shares would trade between 5 and 6 times 2026 revenue. That’s a much more palatable valuation, although it will take some patience and execution to get there.

Should you invest in SoundHound?

Clearly, SoundHound AI’s end markets alone would support a $20 billion valuation. According to management, the voice AI market has a total addressable market size of at least $140 billion. SoundHound AI’s unique technology can be used across a variety of industries, and its early head start bodes well for its ability to capture a growing share of an otherwise growing opportunity.

But there’s a reason SoundHound still trades at a paltry $1.7 billion market cap. The company remains unprofitable, meaning it continually needs to seek financing in order to stay solvent. This limits its ability to invest in research and development, which is perhaps its most valuable use of funds long term.

Research and development spending last year was only around $56 million — a 30% reduction in its peak spending levels in 2023. Big tech companies, including Apple and Alphabet, are investing billions of dollars in this space. Long-term competition will be intense, and it’s not clear whether SoundHound AI has the capital to survive, let alone thrive.

If you’re looking for a speculative growth stock with huge long-term potential, SoundHound AI could be for you. Nvidia’s backing is certainly a plus. But volatility should remain high, and the potential downside is sizable as well. This is truly a boom or bust investment option for risk-tolerant investors only.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Just Made a 147% Profit Betting on This AI Stock was originally published by The Motley Fool