Companies around the world paid a record $606.1 billion in dividends to their shareholders during the second quarter — 8.2% more than the prior-year period. Nearly 90% of dividend-paying companies have either held their payments steady or raised them over the past year.

This data suggests that right now is a great time for dividends. However, that’s not always the case. Downturns and recessions can severely impact the ability of some companies to continue making those payments.

While some companies might at some point be unable to maintain their dividends, Enterprise Products Partners (NYSE: EPD), Enbridge (NYSE: ENB), and American States Water (NYSE: AWR) are models of dividend durability. They’ve continued doling out those payments to investors over the years no matter what. Because of that, they stand out to a few Fool.com contributors as great stocks to buy for those seeking reliable dividend payments.

Enterprise is ready to pay you (well)

Reuben Gregg Brewer (Enterprise Products Partners): The honest truth is that most investors will probably find Enterprise Products Partners’ 7.2% distribution yield to be the main attraction of its stock. Given the S&P 500‘s miserly current yield of just 1.2%, that’s not shocking. But when it comes to creating a passive income stream, there’s a lot more than that to like about Enterprise Products Partners.

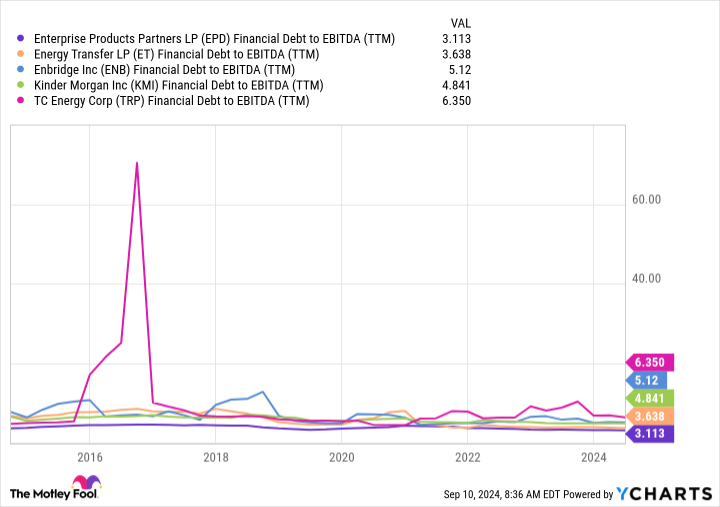

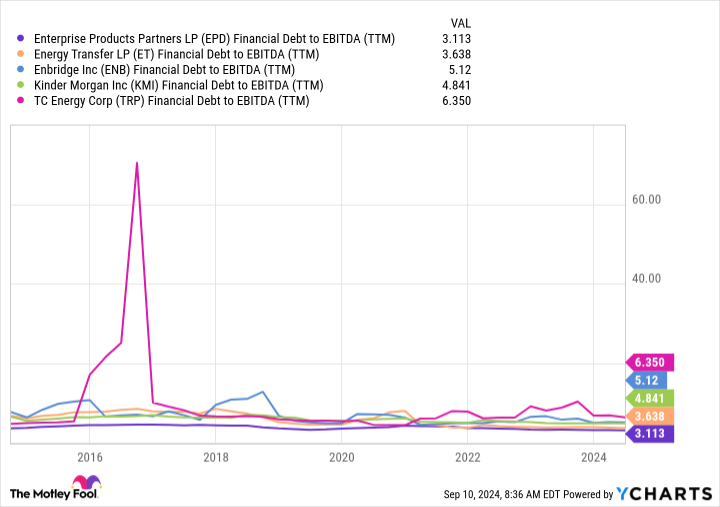

For starters, there’s its position as one of the largest midstream energy businesses in North America. It owns a virtually unduplicatable network of energy infrastructure assets — pipelines, storage facilities, processing facilities, and more — that produces reliable fee income over time. That is what supports the dividend, and its distributable cash flow covers its distribution by a safe 1.7 times. On top of that, Enterprise’s balance sheet is investment-grade rated, so there’s little reason to worry about it needing to cut its distribution. Also notable is the fact that Enterprise is one of the most financially conservative players in its peer group, and has been for years. So what you see today is really what you’ll be getting for the long term.

That all leads up to the next big number on the distribution front, which is 26. That’s the number of consecutive years that the energy company has increased its distribution. If you are looking for a reliable high-yield income stock, Enterprise Products Partners should be on your short list.

Proven dividend durability

Matt DiLallo (Enbridge): Enbridge pays one of the most reliable dividends in the energy sector. The Canadian pipeline and utility company has made dividend payments for more than 69 years, and increased those payments for 29 straight years. That streak should continue no matter the market conditions.

Driving that view is the overall durability and predictability of Enbridge’s earnings. The company has met its annual financial guidance for 18 straight years. That period included two major recessions and two other periods of oil market turbulence. Enbridge has an extremely stable earnings profile, with 98% of its income coming from cost-of-service or contracted assets. It also gets more than 95% of its earnings from investment-grade rated customers. Meanwhile, about 80% of its earnings come from contracts with inflation protections in place.

Enbridge’s target is to pay out 60% to 70% of its stable earnings in dividends. That enables it to retain a meaningful percentage of its cash flow to fund expansion projects. The company also has a solid investment-grade balance sheet. Its leverage ratio was 4.7 at the end of the second quarter, and is on pace to slide toward the low end of its 4.5 to 5.0 target range by next year as the company captures the full benefit of its recent natural gas utility acquisitions.

Those deals will help it grow its earnings over several years. In addition, the company has an extensive backlog of capital projects. These help support management’s view that it can grow its earnings at an annual rate of around 5% over the medium term.

With a strong financial profile and visible growth coming down the pipeline, Enbridge should have plenty of fuel to continue increasing its dividend, which yields more than 6.5% these days. Those features make Enbridge an excellent option for those seeking a dividend they can bank on.

70 years of dividend raises and counting

Neha Chamaria (American States Water): When it comes to dividends, American States Water has achieved something no other publicly listed stock in the U.S. has — it has increased its dividend every year for the past 70 consecutive years. That makes American States Water stock the Dividend King with the longest active streak of dividend increases. Yes, this is one stock that doesn’t just pay you a dividend, but also sends ever-fatter checks your way every year, no matter what.

It doesn’t take much to guess why American States Water has been such a bankable dividend stock. It’s a regulated water utility and generates stable and predictable cash flows from its services. It provides water services to more than 1 million people across nine states, and also has an electric utility subsidiary. That aside, American States Water’s contracted services subsidiary provides water and wastewater services to 12 military bases in the U.S. under 50-year contracts and one under a 15-year contract.

What’s truly remarkable about American States Water’s dividend is its pace of growth. It has grown its dividend at a compound annual rate of 8.8% over the past five years, and 8% over the past 10. Its latest hike, announced in August, was an 8.3% boost. That’s rock-solid dividend growth coming from a utility. With American States Water also targeting at least 7% payout growth in the long term, this 2.3%-yielding dividend stock is the kind every income investor would want to own.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Matt DiLallo has positions in Enbridge and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Rewarding Dividends: 3 Stocks That Pay Out No Matter What was originally published by The Motley Fool