Aerospace manufacturer and satellite launcher Rocket Lab cleared an aggressive buy point Wednesday as shares of the SpaceX rival spiked. Meanwhile, space-based telecommunications provider AST SpaceMobile (ASTS) rebounded above a key moving average.

↑

X

How To Buy Stocks: Three-Weeks-Tight Chart Pattern

Long Beach, Calif.-based Rocket Lab USA (RKLB) provides aerospace launching services and produces components for small to medium-sized spacecraft and satellites, with the goal of making space launches more accessible and affordable. The company on Oct. 7 announced it was selected by NASA to complete a study for retrieving rock samples from Mars and returning them to Earth. Financial details were not disclosed.

Rocket Lab is working on a mission concept, which it says will be delivered at a “fraction” of the current projected program cost and conclude several years earlier than the current expected return date in 2040.

“Retrieving samples from Mars is one of the most ambitious and scientifically important endeavors humanity has ever embarked upon,” founder and CEO Sir Peter Beck said in the news release. “Rocket Lab has been methodically implementing a strategy for cost-effective planetary science in recent years, making us uniquely suited to deliver a low cost, rapid Mars Sample Return.”

Rocket Lab previously delivered a NASA mission to the Moon and delivered two spacecraft to NASA for a Mars mission. The company also helped facilitate operations in orbit and successfully re-entered a capsule from orbit to Earth, among other missions.

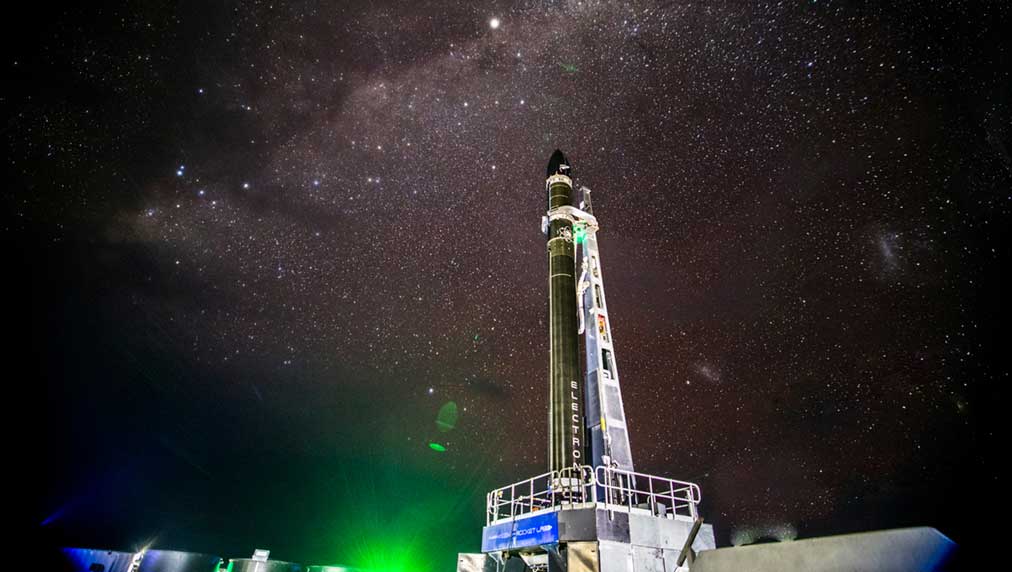

Rocket Lab boasts that it successfully deployed 197 satellites across 53 launches of its Electron rocket. Meanwhile, there are more than 1,700 satellites in orbit with Rocket Lab technology, according to the company website.

But that pales in comparison to SpaceX, which dominates launch services. Elon Musk’s company has completed 392 total launches and hopes to eventually colonize Mars. Meanwhile, Starlink, Musk’s satellite company, has more than 6,400 satellites in orbit as of September, Space.com reported.

Analyst Outlooks

Meanwhile, KeyBanc lifted its price target on Rocket Lab stock to $11 from $8 at the end of September after a roadshow with the company, The Fly reported. KeyBank says it is increasingly confident in Rocket Lab’s ability to scale its business. Additionally, KeyBanc also believes Rocket Lab is positioning itself to be an industry leader in launch services and satellite manufacturing and design. The firm maintained an overweight rating on RKLB stock.

JMP Securities initiated coverage of Rocket Lab in mid-September with a market perform rating. The firm said there are “several strong, fundamental aspects” to Rocket Lab. However, there are near-term risks, including rising launch costs and increased competition, particularly with the threat of SpaceX. There’s also uncertainty around Neutron, Rocket Lab’s deep-space cargo spacecraft, JMP added. The firm omitted a price target until there is more positive clarity.

Rocket Lab Stock

Rocket Lab stock leapt 12.6% to 11.19 Wednesday to clear a 10.29 buy point for a three-weeks-tight pattern.

Investors could also view the pattern as a high-tight flag following a strong run-up.

RKLB stock has vaulted more than 220% from its mid-April lows. Shares rallied 102% so far this year.

The huge advance makes Rocket Labs stock vulnerable to a sharp pullback. Revenue growth has accelerated for three straight quarters, but the company is still losing money. The space business is fraught with major risks.

Meanwhile, ASTS stock spiked 16.4% Wednesday and cleared resistance to close above its 50-day moving average. The above the technical level also made shares actionable.

AST SpaceMobile rocketed about 368% in 2024.

AST SpaceMobile’s business has some overlap with Starlink but is using SpaceX for satellite launches.

You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Join IBD Live And Learn Top Chart Reading And Trading Techniques From Pros

Learn How To Time The Market With IBD’s ETF Market Strategy

Futures: Nvidia Rises In Buy Area; Why Nuclear Stocks Are Radioactive Now