Warren Buffett once famously said, “Be fearful when others are greedy and greedy when others are fearful.” With that in mind, here are three tech stocks investors should consider piling into while others have become fearful.

1. Alphabet

Alphabet (NASDAQ: GOOGL) shares have sold off recently on concern about increasing competition in search as well as a court ruling that the company’s Google search engine is a monopoly.

Although Alphabet has been found guilty of antitrust practices, a final resolution to the court ruling and what remedies are put in place will likely take quite some time to be implemented. It wouldn’t be surprising if it stretches out into 2026. The court ruling focused mainly on the company’s payments to smartphone makers to be the exclusive default search engine of their mobile devices, so there will likely be changes to these agreements.

Meanwhile, investors have become worried about the financial effect artificial intelligence (AI) will have on Google’s business model as well as what impact AI-powered search engines from the likes of OpenAI and Perplexity will have on the company.

Both of these issues look more than manageable. First, Alphabet has started to innovate on the search front not just through AI, but with features such as visual search and circle to search. The former lets users conduct a search using the smartphone’s camera, while the latter lets users circle or even scribble on an image or text to get more information about a subject, without leaving an app.

With Alphabet’s decades of data, a brand synonymous with internet search, a business that throws off huge cash flow, and new monetization opportunities stemming from AI, it will not be easy for a money-losing, sub-scale competitor to make any meaningful inroads into Google’s search dominance. While the court ruling likely will make it easier for users to switch default search engines, the company has about two years to make sure not many people will want to by further increasing its technological lead in search.

Trading at a forward price-to-earnings (P/E) ratio of less than 19, the stock is a bargain given the growth opportunities in front of it.

2. Taiwan Semiconductor Manufacturing

Shares of Taiwan Semiconductor Manufacturing Company (NYSE: TSM), or TSMC for short, sold off earlier this summer on news of tougher export restrictions on semiconductors to China, as well as comments from presidential candidate Donald Trump claiming that Taiwan had taken 100% of the chip business from the U.S. and that it should pay for its own military.

Although there are certainly geopolitical risks when it comes to investing in TSMC, given Taiwan’s importance to chip manufacturing and the havoc it would cause if there was a disruption, these risks are likely overblown. Meanwhile, as the leading semiconductor contract manufacturer in the world, the company is set to continue to nicely benefit from the buildout of AI infrastructure.

The company’s revenue rose nearly 33% year over year in Q2 to $20.8 billion, while it recently reported that it had its best sales month ever in July, with revenue rising 45% in the month. The company has been expanding production to meet high demand, and is expected to raise prices by as much as 10% next year for some smaller nodes. This should lead to some very nice growth next year.

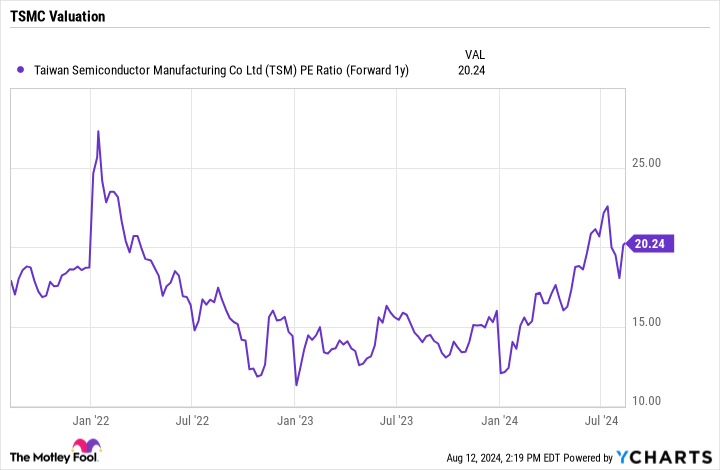

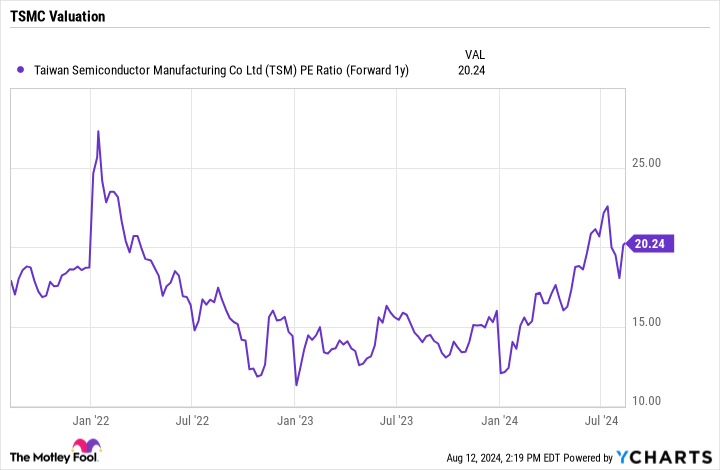

Trading at a 20 times forward P/E based on 2025 analyst estimates, the stock is too cheap to ignore given its growth outlook.

3. Nvidia

After a strong run, shares of Nvidia (NASDAQ: NVDA) have pulled back on worries the stock has run too far too fast and that there would be delays for its newest Blackwell chip. While the latter is probably true, demand for its chips is so high that it likely will have only a minimal impact on its results, as customers continue to scoop up its current-generation Hopper chips instead.

Although there is some worry that AI infrastructure spending could slow, the commentary from the the major companies involved in the AI buildout all point to increased investments ahead. At this point, the worry among customers is not overbuilding capacity, but not building enough capacity. Meanwhile, the more advanced large language models (LLMs) become, the more computing power they will need.

For example, Meta Platforms recently said its Llama 4 LLM would likely need 10 times the computing power to train compared to Llama 3. That means the need for a lot more graphics processing units (GPUs) from Nvidia.

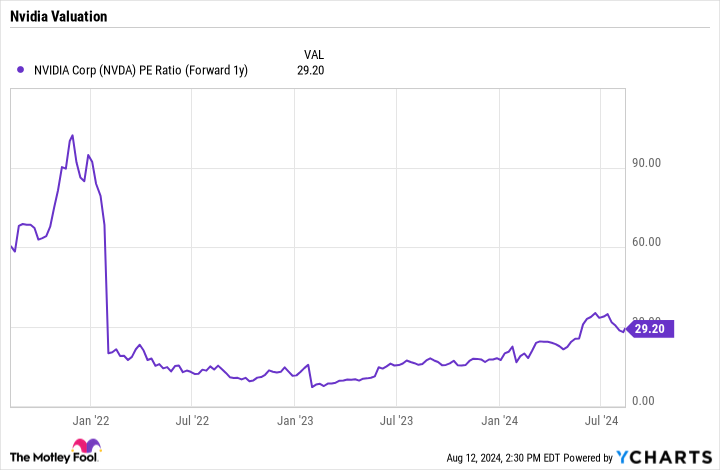

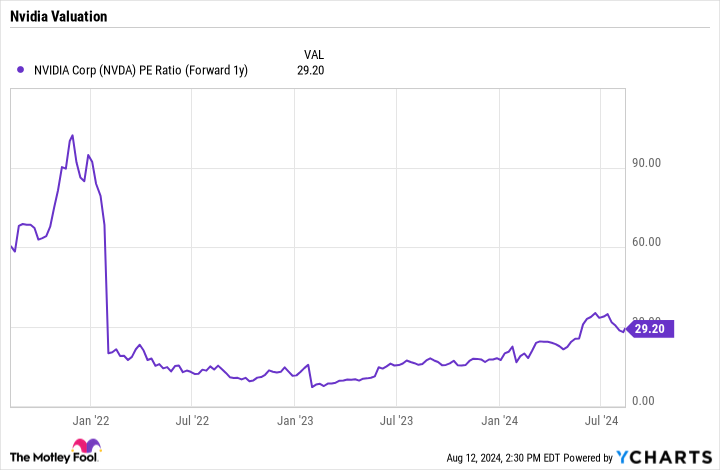

With demand not letting up, Nvidia’s stock looks inexpensive trading at under 30 times next year’s earnings consensus. This looks like a great time to buy the dip.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $723,545!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The Best Stocks to Invest $50,000 in Right Now was originally published by The Motley Fool