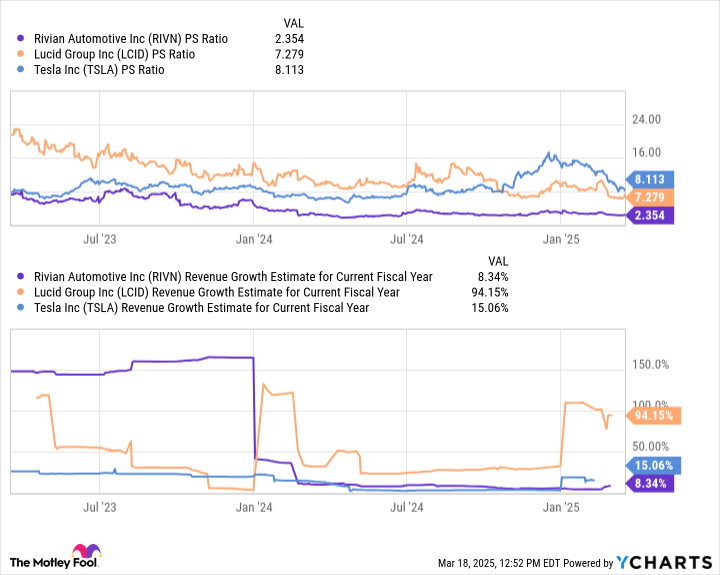

Typically, stocks expected to grow sales significantly in the year to come are priced at a premium. And to be sure, Lucid Group (NASDAQ: LCID) shares aren’t necessarily cheap at 7.3 times sales. But after a sharp correction, its shares are cheaper than they’ve been in years, while growth estimates for 2025 call for sales to jump by nearly 100%.

As a whole, electric car stocks had a rough start to 2025. Competitors like Tesla and Rivian Automotive saw their valuations plummet by 30% or more in a matter of weeks. Lucid Group was no exception, especially after the departure of its longtime CEO in February.

Right now, Lucid trades at a discount to Tesla, but a premium to Rivian. The premium versus Rivian make sense, considering Lucid is expected to grow revenue by 94% this year versus just 8% growth for Rivian. What doesn’t make as much sense, at least according to the raw numbers, is Lucid’s relative discount to Tesla shares. Lucid’s growth rate in 2025 is projected to be six times higher than Tesla’s, yet Tesla shares trade at a premium.

Tesla, of course, has significant long-term advantages that are not captured in near-term growth rates. It has near-ubiquitous brand-name recognition, as well as a sizable capital advantage — a big deal in an industry rife with historical bankruptcies.

But Lucid’s relative discount still sticks out as an opportunity following an industry-wide correction. The company’s Gravity SUV platform should boost sales growth considerably this year. And if management is to believed, several new mass market vehicles in 2026 could help sustain elevated growth rates for years to come.

There’s a lot of risk here, especially considering the CEO’s sudden departure. But shares now trade near an all-time low valuation just as growth rates are expected to ramp considerably, providing an opportunity for aggressive growth investors willing to buy and hold.

Before you buy stock in Lucid Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lucid Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $726,481!*

Now, it’s worth noting Stock Advisor’s total average return is 835% — a market-crushing outperformance compared to 164% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »