The stock market is having a good year despite headwinds from sticky inflation and high interest rates. The benchmark S&P 500 (SNPINDEX: ^GSPC) has climbed 18%, notching more than three dozen record highs in the process.

One reason for that momentum is excitement about artificial intelligence (AI). Chipmaker Nvidia accounts for nearly one-fifth of the gains in the S&P 500, and the Magnificent Seven are collectively responsible for nearly 60% of the gains. Another reason for the market’s upward momentum is that most economists expect the Federal Reserve to achieve a soft landing, a scenario in which policymakers bring inflation back to target without causing a recession.

Here’s how JPMorgan Chase analysts summarized the situation in their mid-year outlook: “The economy is stronger than you think. AI is just starting. Stocks could move higher. Embrace the rally.”

However, the stock market could be headed for trouble, at least temporarily, because the S&P 500 usually declines in September.

History says the “September Effect” will drag the S&P 500 down

Historically, September has been the worst month of the year for the U.S. stock market. In fact, the market has declined so consistently in that particular month that the phenomenon is called the “September Effect.” As an example, the S&P 500 has declined in 7 of the 10 Septembers since 2014, or 70% of the time. And the declines have often been brutal, especially in recent years, as listed below.

-

2014: (1.6%)

-

2015: (2.7%)

-

2016: (0.1%)

-

2017: 1.9%

-

2018: 0.4%

-

2019: 1.7%

-

2020: (3.9%)

-

2021: (4.8%)

-

2022: (9.3%)

-

2023: (4.9%)

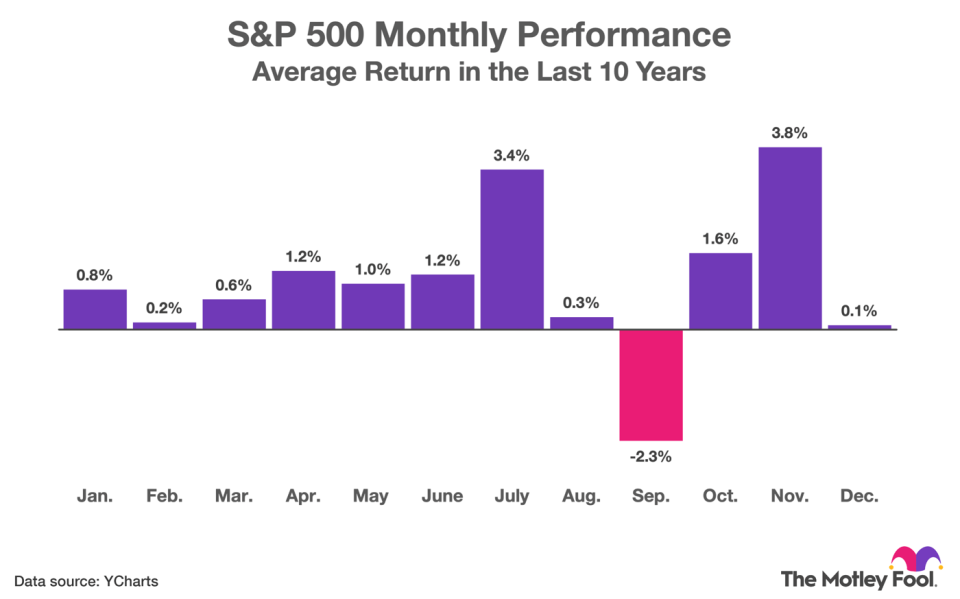

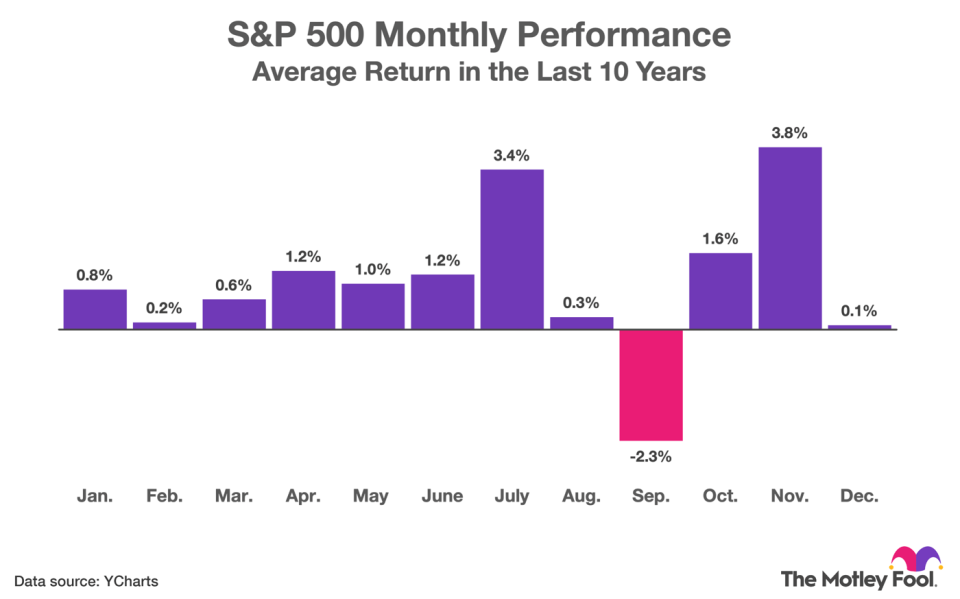

There is a silver lining to the September Effect. The S&P 500 typically rebounds during the subsequent months of the year, and November has been the best month for the index during the last decade, as shown in the chart below.

As shown above, during the last decade, the S&P 500 has declined by an average of 2.3% in September. But the index has also rebounded sharply in October and November.

Importantly, a similar pattern holds over longer periods. Using hypothetical data back-tested to 1928, the S&P 500 has declined 56% of the time during September, and the index has fallen by an average of 1.2%, according to Yardeni Research. However, the S&P 500 has also produced a positive return more often than not in October, November, and December.

That said, past performance is never a guarantee of future results. More importantly, it is macroeconomic fundamentals and corporate financial results that drive the stock market, not random circumstances like the month of the year.

Marketing timing strategies are prone to failure

Investors may be tempted to skip September by selling stocks now and buying again once the month has ended. That would be a sensible strategy if the S&P 500 was guaranteed to decline in September. But no one knows with absolute certainty what the stock market will do on any given day, let alone for an entire month.

The problem with market timing strategies is that missing a few good days can have lasting consequences. For instance, $10,000 invested in an S&P 500 index fund in July 2004 would have grown into $73,172 by July 2024, according to JPMorgan. In that scenario, the money compounded at 10.5% annually. However, if the 10 best days are eliminated, that $10,000 investment would have been worth just $33,523 by July 2024. In that scenario, the money compounded at 6.2% annually.

When presented with those facts, investors have asked: “Okay, but what would my return have been if I avoided the 10 worst days?” In that case, the returns would have exceeded 10.5% annually, but anyone who asks that question is missing the point. Not even Wall Street analysts can accurately predict stock market movements, at least not consistently. So, why risk long-term underperformance?

In December 2023, Wall Street analysts at 13 investment banks said they expected the S&P 500 to finish 2024 between 4,200 and 5,200. Essentially all of those analysts have since revised their forecasts because the index currently trades at 5,625, which is 8% higher than the highest initial price target. Of course, the market could backslide before the year ends, but that would not change the fact that it’s impossible to consistently predict stock market ups and downs.

Here’s the bottom line: Investors should stay invested through September. If the market declines, use the drawdown to buy a few shares of your favorite stocks. If the market goes up, be glad you stayed invested. Either way, remember the golden rule: It is not timing the market that matters, but rather time in the market.

Personally, I like JPMorgan’s assessment of the situation. The artificial intelligence boom is just getting started, and many AI stocks are sure to move higher in the long run.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends JPMorgan Chase and Nvidia. The Motley Fool has a disclosure policy.

This Stock Market Indicator Has Been 70% Accurate Since 2014. It Signals a Big Move in September. was originally published by The Motley Fool