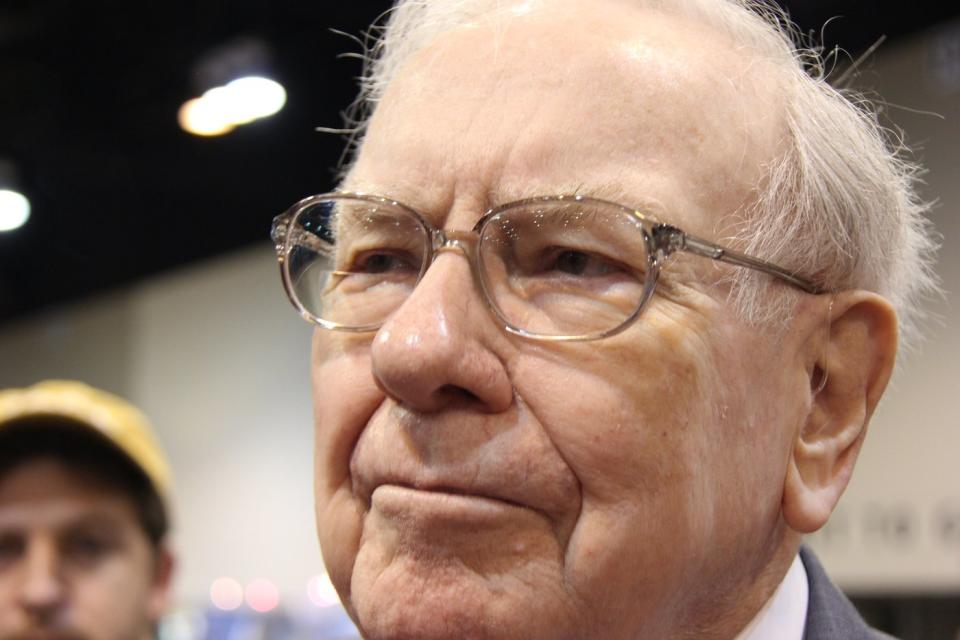

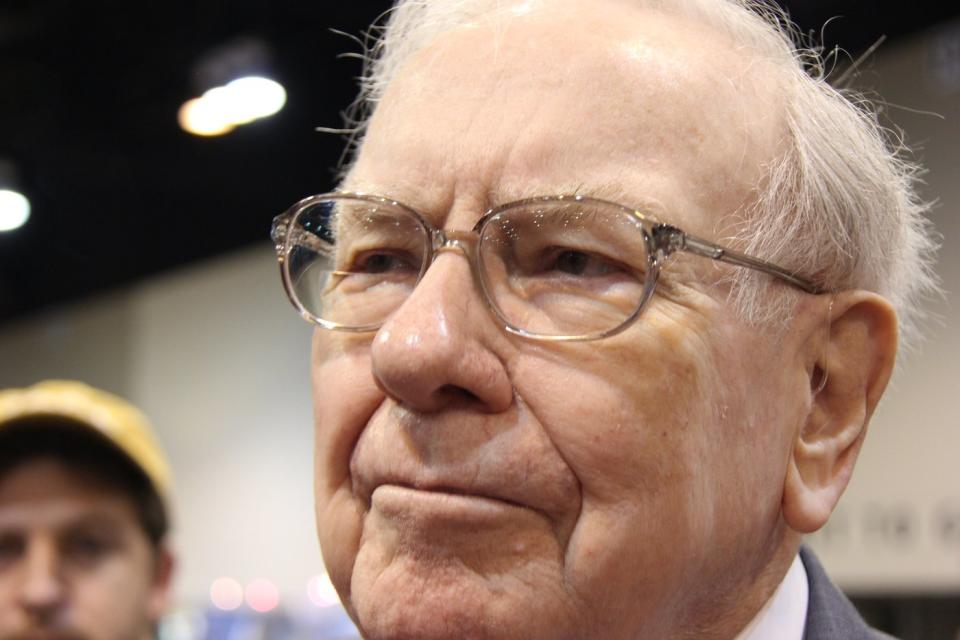

Warren Buffett is considered one of the greatest investors of all time, and he has the track record to prove it. He took Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) from a struggling textile business in the 1960s to a massive conglomerate worth $900 billion today by buying highly valuable businesses at a fair price. Since Buffett took over the company, Berkshire Hathaway’s share value has grown at an average compound annual rate of 19.8%, well above the 10.2% returned by the S&P 500 over the same period.

Buffett is in charge of almost all of Berkshire’s equity portfolio and managing the company’s cash position. But last quarter was the biggest warning yet that Buffett doesn’t see a lot to like in the current stock market. That’s reflected in Berkshire’s cash and Treasury bill position, which ballooned to $277 billion in the second quarter, up $88 billion from the previous quarter.

Here’s how Berkshire got here, and what it means for investors.

Buffett just made his biggest stock sale in history

Buffett sold over $77 billion worth of stocks in Q2. That far exceeds any amount Buffett has ever sold in any given year, let alone in a single quarter. With just $1.6 billion in stock purchases last quarter, that makes seven straight quarters where Buffett has been a net seller of stocks.

By far the biggest stock sale was Buffett’s decision to trim Berkshire’s position in Apple (NASDAQ: AAPL). At one point, Apple accounted for nearly 50% of Berkshire’s entire portfolio. As of June 30, though, Berkshire’s Apple shares were worth $84.2 billion, or 29.5% of the company’s equity investments. That suggests a sale of about half of Berkshire’s Apple shares last quarter.

That’s the third straight quarter Buffett has trimmed his stake in Apple, a company he called “a better business than any we own” at last year’s shareholder meeting. He explained his reasoning behind the sales at the most recent shareholder meeting. He views the current tax code for corporations as very favorable, and he’s willing to pay taxes now, so he can avoid higher taxes later. Berkshire is sitting on a massive capital gain from its Apple investment.

Buffett has also been trimming another top holding since the end of the quarter — he’s sold $3.8 billion worth of Bank of America (NYSE: BAC) stock since mid-July. Berkshire is taking a substantial gain on those shares as well.

That said, it’s one thing to strategically take capital gains to lock in a low tax rate. But Buffett could reinvest that cash (less the estimated tax bill) right away if he saw good opportunities in the market. He could even immediately buy back the shares he sold without any penalty since the wash sale rule doesn’t apply for capital gains, only capital losses.

Even Buffett’s penchant for buying one particular stock month after month seems to have gone away in the current market.

Buffett bought this stock for 24 months straight … and then stopped

While Buffett has consistently sold more stocks than he bought for nearly two years, there’s one stock he’s continually used Berkshire’s extra cash to buy month after month: Berkshire Hathaway’s own stock.

Berkshire revamped its share repurchase program in mid-2018, allowing Buffett to buy back shares whenever he considered them to be trading below their intrinsic value. Since then, Buffett has only taken a few months off from buying shares of Berkshire.

In June, however, Buffett didn’t buy back any shares of either class of stock for the first time since May 2022. On top of that, share repurchases for the entire quarter totaled a measly $345 million. That’s the smallest amount since the change in the repurchase authorization in 2018.

Despite the massive amount he’s spent on buying back shares of Berkshire over the last few years, Buffett remains very strict about share repurchases. “All stock repurchases should be price-dependent. What is sensible at a discount to business-value becomes stupid if done at a premium,” he wrote in his 2023 letter to shareholders.

That suggests Buffett doesn’t even find his own company’s stock to be a good value these days. With nowhere appealing to invest the cash, Berkshire’s cash and Treasury bill holdings will continue to grow.

What it all means for investors

While Buffett is always bullish on the American economy in the long term, he doesn’t seem to see a lot of great investments in the stock market right now. Valuations are stretched, and future expected returns don’t look as good as in the recent past. Investors may have a tough time finding good value in today’s market even after the recent pullback in stocks. Despite the recent sell-off, the S&P 500 still trades at around the same level as it did in May.

That said, Buffett’s circumstances are far different from the average investor’s. He has an equity portfolio worth about $300 billion and another $277 billion in cash. That’s a massive portfolio to manage, which severely limits the options for Berkshire to a few large-cap stocks or some big privately-owned businesses.

The average investor has a whole range of stocks they could add to their portfolio. Small-cap stocks still look attractive. Or investors could buy a simple broad-based index fund, one of Buffett’s top recommendations for retail investors, and call it a day.

While investors shouldn’t ignore the warnings woven into Buffett’s latest moves, it’s also important to consider your alternatives. The stock market still looks like the best way to grow your wealth over the long term.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Just Sent a $277 Billion Warning to Stock Investors was originally published by The Motley Fool