I-HWA CHENG / Contributor / Getty Images

The Nvidia GB200 NVL72 displayed at Computex 2024 in Taipei on June 4, 2024.

Key Takeaways

-

Chip stocks rallied Thursday, rebounding from losses earlier in the week stemming from economic worries and reports of delays in the launch of Nvidia’s new Blackwell chip.

-

Thursday’s surge came amid signs that the economic concerns may have been overblown, following a better-than-expected weekly jobless claims report.

-

Expecting Nvidia and other chip stocks to benefit from longer-term trends in demand for artificial intelligence, analysts suggested recent volatility could offer investors an opportunity to buy the dip.

Nvidia (NVDA), Advanced Micro Devices (AMD), Broadcom (AVGO), and other semiconductor stocks rallied Thursday, rebounding from losses earlier in the week that were sparked by worries about the U.S. economy and reports of delays in the launch of Nvidia’s new Blackwell chip.

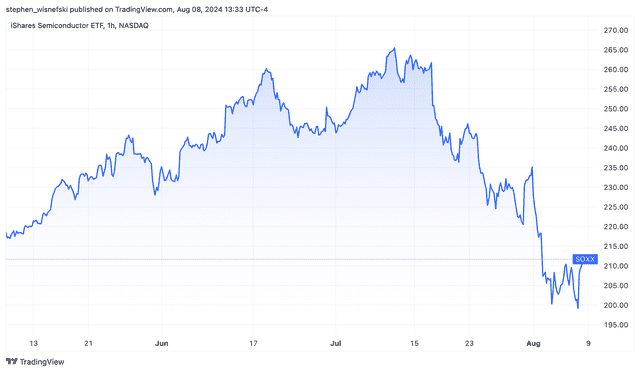

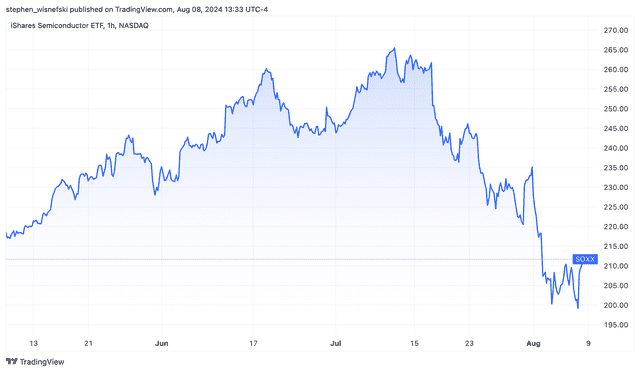

The iShares Semiconductor ETF (SOXX) was up over 6% in afternoon trading Thursday after dropping nearly 3% Wednesday. Chip stocks have swung wildly in recent weeks, most notably since a weaker-than-expected July jobs report last Friday sent markets into a tailspin.

The rally in chip stocks Thursday helped power gains for the major indexes Thursday, with the tech sector leading gains for the S&P 500, which was up 2.3%. The tech-heavy Nasdaq surged 2.9%.

Economic Worries Overblown?

Thursday’s surge came amid some signs that worries fueling the global sell-off earlier in the week may have been overblown, as Thursday’s jobless claims data showed that fewer people applied for unemployment insurance benefits than economists had expected.

Expectations of Federal Reserve rate cuts eased somewhat, with markets now pricing in a 55% chance of the central bank cutting rates by half a point in September, according to the CME Group’s FedWatch tool based on fed funds futures data. That’s down from 99% earlier this week, when speculation mounted that the Fed could be pushed to make an emergency cut.

Short-Term Volatility Offers Opportunity To Buy the Dip, Analysts Say

With chip stocks expected to benefit from growing artificial intelligence (AI) demand in the longer term, analysts suggested the recent volatility could offer investors an opportunity to buy the dip in Nvidia and other chip stocks.

Weighing in on reports Nvidia’s new Blackwell AI chip could be delayed, analysts at Piper Sandler, Oppenheimer, Bank of America, and Goldman Sachs indicated they anticipate little impact to the chipmaker’s long-term prospects, highlighting Nvidia’s AI strengths.

Nvidia told Investopedia Tuesday it expects production of Blackwell is still “on track” to ramp in the second half of the year.

Shares of Nvidia, Broadcom and AMD were all up more than 5% in recent trading.

Read the original article on Investopedia.